The need for change has never been clearer. At the same time, knowing the changes to make, with limited resources, has rarely been more obscure.

Things change. It’s a fact of life. Whether the seasons, our age, or the weather, change keeps happening.

Today, with all of the latest hype around Artificial Intelligence, Machine Learning, Robotics and Digital Transformation, the reason for change to begin with gets lost in the buzz. You gloss over the “Why?” as you fall to the clamor that you just need these things.

Do you really need to jump into these technology trends?

Maybe. Maybe after the hype dies down a bit, and solution maturity picks up, these would be good options. Until then, two seismic shifts are taking place in the global economy: business models are constantly at risk of disruption or “creative destruction,” and businesses are globally moving toward less of an ownership economy and more of an experience economy. Ownership with transaction business is not going away; a significant market segment is simply looking for something different.

As we navigate the fog of the technology buzz, we must maintain focus on why technology exists now more than ever. Technology exists in business to serve the needs of the business. Ultimately, that means technology should serve the needs of the customers of that business.

Statistics on Business Model Disruption and Transformation

I knew business model disruption was common these days, but until I looked into some of the statistics, I had no idea how common disruption is, or how concerned some business leaders are.

For example, McKinsey did a CEO survey and found that 80% of CEOs believed their business models were at risk from competitors [FN1]. The disruption concern of CEOs is also supported by evidence [FN2].

As if that is not sobering enough, the pace of “creative destruction” of businesses, industries, and business models continues to accelerate.

“The 33-year average tenure of companies on the S&P 500 in 1964 narrowed to 24 years by 2016 and is forecast to shrink to just 12 years by 2027.” [FN3]

The twelve years for 2027 are estimated based on historical trends.

Seeking Alpha (a financial and stock investment publication) has done a great job cataloging research by others on the changes in the S&P 500. What they show is a rolling seven-year, oscillating pattern (up and down) with important data to evaluate. Whether you look at peak to peak, evaluate valley to valley, or use an average trend line, the message is the same. Company lifespans are shrinking at an accelerating pace [see the chart on the Seeking Alpha hyperlink below at FN2]:

Peak to Peak

Valley to Valley

The case for meaningful change has never been clearer. Combine this with the latest buzzword technologies enabling that change, and the clamor makes your choices cloudy with a heavy dose of confusion.

Customer Experience and Future Business Model Trends

With limited budgets, too many buzzword options, and a need to find avenues to beat back competitors, technology investments cannot afford to miss market opportunities. Unlike some of the buzzier technologies, today’s digital business landscape has discernible trends.

Current economic trends are moving in the direction of the “experience economy.” We see this in the huge number of businesses, across a wide variety of industry verticals, who are experimenting with subscription-based business models. Businesses are pursuing recurring revenue and recurring billing payments over individual transactions. Widely known and respected publications routinely report on the diverse adoption of subscription-based digital business models. For example, refer to the sample publications in the footnote below [FN4].

How Business Models are Changing in the New Customer Experience Use Based and Subscription Economy

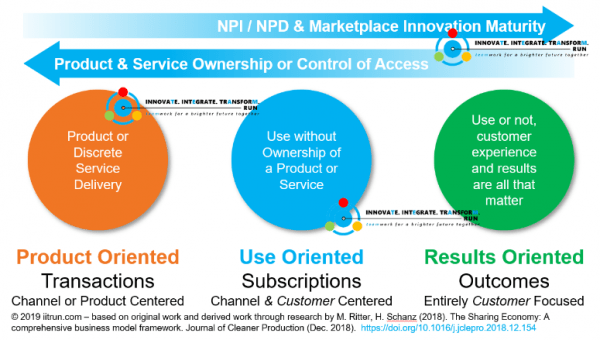

Recent research shows the global economy’s direction moving from discrete transactions with clear ownership, to product or service use and managing subscriptions. This illustration was derived from 2018 academic research on the sharing economy using a business model framework [FN5]. This is the ongoing business model transformation your competitors are undertaking.

With the drive for subscription processing, several subscription billing platforms have appeared. Not all of these subscription software options are equal, and they may have significant gaps for various types of subscription models.

While point solutions are available for subscription billing that manage subscriptions, or recurring billing, most of these solutions have significant hidden investments in custom integration, missing capabilities, data harmonization, and financial integration. These solutions also often have difficulties with fully processing tangible goods or providing third-party goods or services. This additional complexity creates ongoing technical debt to maintain and support.

You need to understand the fit of the solution for your whole business, and the hidden integration and development costs.

Along with the subscription management gaps, if you get creative with your subscription options and include third-party products or services, the complexity and cost of integration can skyrocket. Holistic reporting and analytics for these more disruptive subscription models requires additional development and integration work for your reporting system, which then consumes even more time and cost. Finding resources who know the subscription package, to perform interface or development work, is limited and costly, which presents several hidden traps in using some of these packages.

Subscription Billing Platforms and ERP

I came across an article from Zuora (a leading subscription software vendor) that criticized ERP products by claiming they did not work for subscription billing processes [FN6].

First, the curious part of the Zuora criticism is they do not mention any ERP package by name. Other than their first claim of a gap for subscription- and revenue-specific KPIs, they allege ERP vendors have no 360-degree customer view [FN7]. In many ways, this claim is almost laughable. Zuora is who lacks a 360-degree customer view for any product or service processing that is not subscription processing, tightly contained within the very limited scope or their subscription software. The claim of lacking a 360-degree view is misleading at best.

Additionally, the rest of the claims appear false or misrepresented for the larger and more popular ERP packages, such as SAP’s ECC or S/4HANA platforms. In any use cases with Zuora, or for that matter any subscription billing system, you must understand the fit of the solution for your whole business, and the hidden integration and development costs. For example, consider the following questions:

- Does the subscription management system have sample entitlement interfaces?

- Does the recurring billing software include usage and rating example interfaces?

- Are there pre-built interface options (not just API calls) for e-commerce integration?

- What packages have pre-built interfaces for their subscription solution?

- What functionality is supported by any pre-built interfaces for their subscription solution?

- Does any maintenance agreement include supporting the integrations (entitlements, usage, ERP, finance, reporting – BI/BW)?

- How are third-party products or services handled?

- What is the process for third-party items, including tracking product or service delivery and vendor payment?

- How are subscription and non-subscription item bundles handled, including the bundle dependent pricing options between subscription and non-subscription items?

- How are bundles with physical products, services, virtual products, or other combinations processed?

- For B2B business, how is credit checking and credit management handled?

- On new product agreements, for shipping requirements, how is product availability and inventory checking handled?

- If they even support Device-as-a-Service processing, how do they process Assets, Warranties, and Asset Depreciation?

- What about physical goods supply planning (inventory management, purchase processing, MRP, warehousing, etc.)?

Subscription billing platforms can easily fill an entire page of gaps, requiring integration, development, and complex processing. However, many of these questions go to the heart of customer experience and directly affect customer satisfaction. These types of gaps clearly show why some of these subscription companies try to deflect away from ERP packages.

Don’t get me wrong– in fairness to Zuora and other subscription billing companies, a profile of companies fit their solution well. If you are a small company, or if your business completely uses subscription processing and does not involve third-party integration requirements (now or in the future), then their subscription management software might be a good option.

Please do your homework and be sure to understand any hidden costs and extra complexity that a narrowly-defined, recurring payment point solution, to manage subscriptions, might end up carrying. You should understand not just extra licensing of an additional product, but the extra maintenance and custom development overhead as well. The spaghetti string integration mess may leave you with technical debt, and possibly unplanned software purchases, long after the subscription management software is sold to you.

Digital Business Transformation in the Customer Experience Economy

As noted before, unless your business is narrowly defined to fit completely into one of the subscription or recurring payment software solutions, you are likely running, or should be running, an ERP package. We have developed a comprehensive X-as-a-Service subscription management platform on SAP’s S/4HANA platform. Except for traditionally maintained external systems such as entitlements, usage, or an e-commerce front-end, our solution is entirely within the SAP ERP package. As a result, you don’t need complex spaghetti string integration.

Our solution includes SAP’s Best Practices reference processes for core business processing, along with our subscription and recurring payment solution built on SAP’s S/4HANA Digital Core. Together with SAP’s pre-packaged ERP Best Practices, we offer reference digital business models for the following:

- Device-as-a-Service

- Data Usage (including IoT)

- Cloud Subscription and Resale (Including Compute, Storage, and Data Usage)

- Flexible Product Bundle Subscriptions

- Supply Fulfillment Subscriptions

- Third-Party product and Service Integration (with or without subscriptions)

- Product, Service, and Maintenance Bundles

- Automatic Renewal Notices

- Automatic Rules Based Contract Renewal Pricing (Opt-in, Opt-out, Evergreen, etc.)

- Promotional Offers

- Flexible Bundle and Subscription Pricing (for mixes of subscription and non-subscription items)

- Pro-Rating for Changes

- Example Middleware for Entitlements

- Example Middleware for Usage Rating

- Example Middleware for Usage Processing

- and much more

Please remember, this is a short listing of our pre-configured and pre-developed subscription models inside of our pre-configured SAP application. This list does not include the overwhelming options for back office processes that SAP’s Digital Core provides with their Best Business Practice pre-configured processes.

Our solution is developed in such a way that you can mix, match, and integrate some or all of these subscription models with each other, natively, with no changes. For example, you can mix Cloud (fee + usage for compute, data, and storage) together with IoT data, Device subscriptions, and software– all in the same contract and even in the same bundle together. If you notice that a creative subscription or bundling model is not covered here, it is generally a matter of setting additional configuration options to allow those options to work together. The flexibility and possibilities have few limitations, unlike so many of the recurring payment and subscription solutions on the market today.

For more information or a demo, please contact us today! We are excited to demonstrate our solution capabilities to support your journey with our recurring payment solutions to manage subscriptions in the experience economy!

[FN1] McKinsey Report on Growth & Innovation, Innovation section Exhibit 2. https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/how-we-help-clients/growth-and-innovation (retrieved May 15, 2019).

[FN2] Sources (retrieved May 15, 2019):

[FN3] 2018 Corporate Longevity Forecast: Creative Destruction is Accelerating. S&P 500 lifespans continue to shrink, requiring new strategies for navigating creative destruction.

https://www.innosight.com/insight/creative-destruction/ (retrieved May 15, 2019).

[FN4] All retrieved May 17, 2019

The Rise Of The Industrial Subscription Economy

FAQ: What the device-as-a-service (DaaS) trend is all about

The State Of The Subscription Economy, 2018

https://www.forbes.com/sites/louiscolumbus/2018/03/04/the-state-of-the-subscription-economy-2018/

Top 10 US subscription video apps pulled in $1.3B last year, a 62% increase from 2017

The Subscription Economy Continues to Dominate

https://banyanhill.com/the-subscription-economy-dominates-business/

Why Every Business Will Soon Be a Subscription Business

https://www.gsb.stanford.edu/insights/why-every-business-will-soon-be-subscription-business

Why and How to Transition to a Subscription Business

http://www.cfo.com/strategy/2018/10/why-and-how-to-transition-to-a-subscription-business/

Subscription and Billing Management Market 2019 Share and Forecast to 2025: SAP, Oracle, Netsuite, Computer Sciences, Zuora, Avangate , Aria Systems, Cleverbridge, Cerillion, Fastspring

[FN5] © 2019 iitrun.com – based on original work and derived work through research by M. Ritter, H. Schanz (2018). The Sharing Economy: A comprehensive business model framework. Journal of Cleaner Production (Dec. 2018). https://doi.org/10.1016/j.jclepro.2018.12.154 (retrieved May 17, 2019).

[FN6] https://www.zuora.com/guides/4-ways-erp-fails-subscription-businesses/ (retrieved May 16, 2019)

[FN7] Monthly recurring revenue (MRR), annual recurring revenue (ARR), and annual contract value (ACV)